Therefore, the market prices of many corn products showed MoM decrease in Jan. 2016. However, some corn products are currently in their traditional sales seasons.

l Corn starch (North China): USD361 .36/t (RMB2,350/t), a MoM fall of 2.77%

l MSG (40 meshes): USD1 ,037.32/t (RMB6,980/t), a MoM fall of 1 .90%

l Maltose syrup (75% content): USD353.67/t (RMB2,300/t), a MoM fall of 4.67%

The sufficient market inventory is the main reason why enterprises were not increasing their quotations.

Since the subsidy policies would come to an end, deep-processing enterprises increased their operating rate at the end of Dec. 2015 to catch the last chance to enjoy the subsidy. As a result, the market supply is sufficient. Take corn starch as an example, the operating rate of corn starch enterprises in Jilin reached 81 % in Dec. 2015. At the end of Dec., the total inventory was 119,700 tonnes in Jilin, up 19.34% year on year (100,300 tonnes in Dec. 201 4).

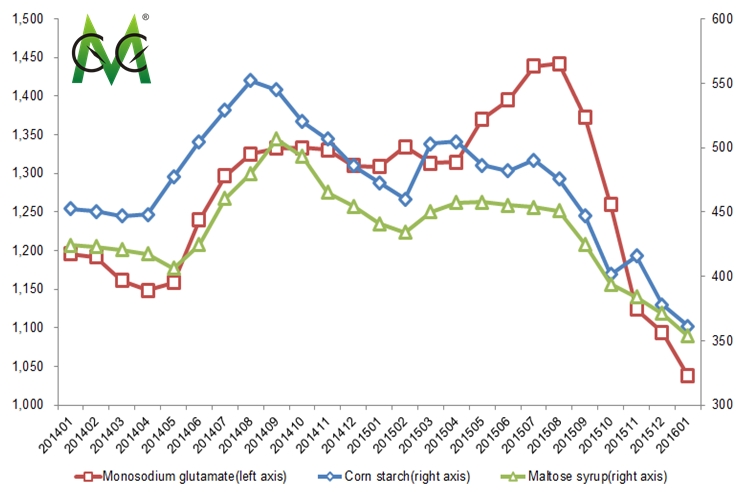

China's market prices of MSG (40 meshes), corn starch (North China) and maltose syrup (75% content), Jan. 2014-Jan. 2016

Note: Unit: USD/t

Source: CCM

At the same time, although enterprises have benefited less from exporting without the export tax rebate, they are still active in quoting export prices. CCM believes that this is attributed to two aspects:

Sluggish domestic market

China's market prices of corn starch (North China), MSG (40 meshes) and maltose syrup (75% content) have hit 4, 3 and 2-year lows. Enterprises are pinning their hopes on the export market due to poor domestic sales.

Devaluation of RMB

According to the People's Bank of China, on 7 Jan., 2015, the USD/RMB exchange rate reached 6.5594. It is predicted that the RMB will keep devaluing, which offsets the increased costs of exporting brought about by the cancelation of the export tax rebate.

For instance, if the average ex-work prices of corn starch (after-tax) is RMB2,300/t in both Jan. 2015 and Jan. 2016 , the cost of exports in Jan. 2015 will be RMB350/t less than that in Jan. 2016 because the export tax rebate rate was applicable in Jan. 2015. However, when the price is converted to dollars, the price difference will be shrunk because of the devaluation of the RMB.

Cost of export of corn starch based on export tax rebate rate and USD/RMB exchange rate, Jan. 2015 & Jan. 2016

|

Time

|

After-tax ex-works price (RMB/t)

|

Value added tax

|

Export tax rebate rate

|

Tax rebate (RMB/t)

|

Cost of export (RMB/t)

|

USD/RMB exchange rate

|

Cost of export (USD/t)

|

|

Jan. 2015

|

2,300

|

17%

|

13%

|

350

|

1,950

|

6.1190

|

318.68

|

|

Jan. 2016

|

2,300

|

17%

|

0

|

0

|

2,300

|

6.5032

|

353.67

|

Note: Tax rebate = after-tax ex-works price / (1+value added tax) * export tax rebate rate;

Cost of export = after-tax ex-works price - tax rebate.

Source: CCM

It is very likely that these two policies will be reimplemented in China.

Firstly, Jilin organized a meeting on 4 Jan., 2016 with corn deep-processing enterprises, discussing their financial conditions after receiving subsidies in Q4 2015. Most enterprises revealed that they have applied for subsidies for H1 2016.

Secondly, since China will speed up the consumption of corn inventories by stimulating the export of corn products, it is predicted that the export tax rebate will be reimplemented.

About CCM:

CCM is the leading market intelligence provider for China’s agriculture, chemicals, food & ingredients and life science markets. Founded in 2001, CCM offers a range of data and content solutions, from price and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailingecontact@cnchemicals.com or calling +86-20-37616606.

Tag: corn